Introduction to PayTrace and its features

Are you looking to streamline your business processes and make payment transactions a breeze? Look no further than PayTrace! This powerful payment processing platform is here to revolutionize the way you handle payments. Join us as we delve into the world of PayTrace login and discover how it can take your business to new heights. Let’s unlock the key to efficiency together.

Benefits of using PayTrace for businesses

Are you looking to streamline your business operations and improve efficiency? PayTrace is the solution you need. By utilizing PayTrace’s secure payment processing system, businesses can experience a wide range of benefits.

One major advantage of using PayTrace is its ability to accept various payment methods, including credit cards, debit cards, and ACH payments. This flexibility allows businesses to cater to a wider customer base and increase sales.

Furthermore, PayTrace offers advanced reporting tools that provide valuable insights into transaction data. With detailed analytics at your fingertips, you can make informed decisions to optimize your business strategies.

Another key benefit of using PayTrace is its user-friendly interface. The platform is intuitive and easy to navigate, making it simple for employees at all levels to process payments efficiently.

Moreover, with top-notch security features in place, such as PCI compliance and encryption technology, you can rest assured that your customers’ data is safe and protected from potential threats.

How to create a PayTrace account

Creating a PayTrace account is a simple and straightforward process that can be completed in just a few steps. To get started, visit the official PayTrace website and locate the “Sign Up” or “Create Account” button. Click on it to begin the registration process.

Next, you will be prompted to enter your business information, including your company name, address, contact details, and payment preferences. Make sure to provide accurate information to ensure smooth account setup.

After entering your details, you will need to verify your email address by clicking on the confirmation link sent to you. This step is crucial for security purposes and ensures that only authorized users have access to your PayTrace account.

Once your email is verified, set up your login credentials – choose a strong password that combines letters, numbers, and special characters for enhanced security. After completing these steps, you’re all set to start using PayTrace’s powerful features for seamless payment processing!

Step-by-step guide on how to login to your PayTrace account

Are you ready to streamline your business operations with PayTrace? Let’s dive into a step-by-step guide on how to login to your PayTrace account effortlessly.

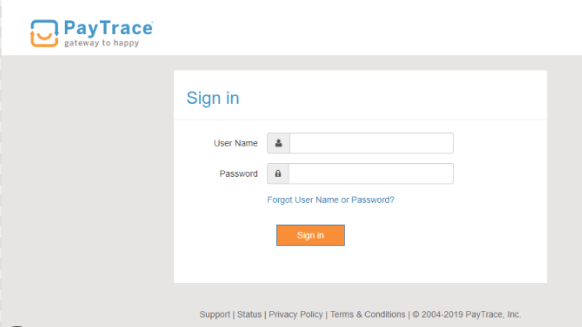

Head over to the official PayTrace website and locate the login button. Click on it to proceed further. Next, enter your username and password that you set up during the account creation process. Make sure to double-check for any typos before hitting the login button.

Once you’ve successfully logged in, you’ll be directed to your personalized dashboard. Here, you can access all the tools and features offered by PayTrace to manage your transactions efficiently. Familiarize yourself with the layout of the dashboard and explore its functions tailored to suit your business needs.

Keep in mind that security is paramount when accessing your account online. Ensure that you use strong passwords and enable two-factor authentication for an added layer of protection against unauthorized access.

By following these simple steps, you’ll be able to access your PayTrace account seamlessly and take full advantage of its capabilities in optimizing your payment processing tasks.

Overview of the dashboard and its functions

The PayTrace dashboard is the control center for your payment processing needs. It provides a user-friendly interface that allows you to navigate seamlessly through various functions. From viewing transaction details to generating reports, the dashboard offers a range of tools to streamline your business operations.

One key feature of the dashboard is its customization options. You can tailor the layout to suit your specific preferences and easily access the information that matters most to you. This flexibility makes managing transactions and tracking sales data a breeze.

With real-time reporting capabilities, the dashboard empowers you with up-to-date insights into your business performance. Monitor transactions as they occur, spot trends, and make informed decisions quickly and efficiently. The intuitive design ensures that you stay in control at all times.

In addition, the dashboard enables you to set up alerts and notifications for important events such as large transactions or chargebacks. This proactive approach helps you stay on top of potential issues before they escalate, enhancing security and peace of mind for your business operations.

Tips for maximizing the use of PayTrace for business operations

Looking to enhance your business operations with PayTrace? Here are some tips to help you make the most of this powerful payment processing tool.

Take advantage of the customizable reporting features offered by PayTrace. By analyzing transaction data and trends, you can gain valuable insights into your customers’ behavior and tailor your business strategies accordingly.

Streamline your checkout process by utilizing the virtual terminal feature for quick and secure payments. This can help improve customer satisfaction and increase conversion rates on your website.

Additionally, consider integrating PayTrace with other third-party applications or e-commerce platforms to further optimize your workflow. Seamless integration can save time and reduce manual errors in data entry.

Stay updated on new features and updates from PayTrace through their customer support channels or newsletters. Keeping abreast of enhancements can ensure that you are leveraging all available tools for maximum efficiency in managing transactions.

Success stories from businesses using PayTrace

Imagine a small boutique in downtown that transformed its sales process with PayTrace. By offering secure online payments, this shop saw a significant increase in revenue while providing customers with a seamless checkout experience. With the convenience of customizable reporting tools, they were able to track and analyze sales data effortlessly.

Another success story comes from a family-owned restaurant that integrated PayTrace into their POS system. This decision not only streamlined their transactions but also improved customer satisfaction through faster payment processing times. The detailed transaction history allowed them to identify peak hours and optimize staffing schedules accordingly.

A tech startup found great value in using PayTrace for recurring billing. With automated invoicing and payment reminders, they saved time on administrative tasks and increased cash flow predictability. This company was able to focus more on product development and growth strategies thanks to the efficiency brought by PayTrace’s features.

Comparison with other payment processing systems

When it comes to payment processing systems, businesses have a myriad of options to choose from. However, what sets PayTrace apart is its user-friendly interface and robust features that cater specifically to the needs of modern businesses.

Unlike other systems that may be cumbersome and complicated, PayTrace offers a streamlined approach to managing transactions efficiently. With real-time reporting and customization options, businesses can tailor their payment processes to align with their unique requirements.

In comparison with traditional processors, PayTrace stands out for its advanced security measures and responsive customer support. This ensures that businesses can operate smoothly without having to worry about potential risks or downtime.

Moreover, the seamless integration capabilities of PayTrace make it easy for businesses to sync their data across multiple platforms effortlessly. This level of convenience sets PayTrace apart as a top choice for companies looking to streamline their operations effectively.

Customer support and security measures

When it comes to running a business, having reliable customer support is essential. PayTrace understands the importance of prompt assistance when issues arise. Their dedicated support team is available to help with any questions or concerns that may come up during your payment processing journey.

In addition to top-notch customer service, PayTrace also prioritizes security measures to ensure your data and transactions are safe and secure. With advanced encryption technology and fraud prevention tools in place, you can trust that your sensitive information is protected from potential threats.

PayTrace goes above and beyond to provide peace of mind for businesses using their platform by implementing industry-leading security protocols. By choosing PayTrace as your payment processing solution, you can rest assured that both your customers’ data and your business’s financial information are in good hands.

Conclusion

Utilizing paytrace login for your business can significantly streamline your payment processes, increase efficiency, and enhance security. With its user-friendly interface, robust features, and reliable customer support, PayTrace is a valuable tool for businesses looking to optimize their payment operations. By following the steps outlined in this guide and exploring the various functions of the dashboard, you can make the most out of PayTrace’s capabilities to drive success for your business. Embrace the convenience and benefits that PayTrace offers and take your business to new heights in the digital payments landscape.